January 2021 is a Seller's market!

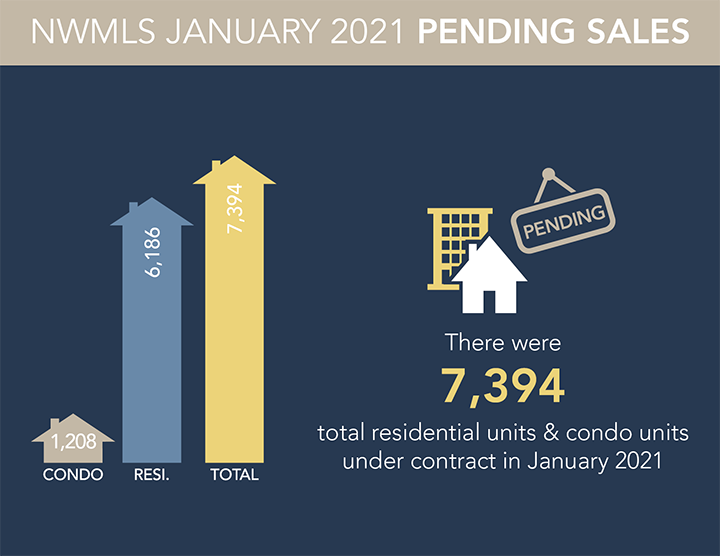

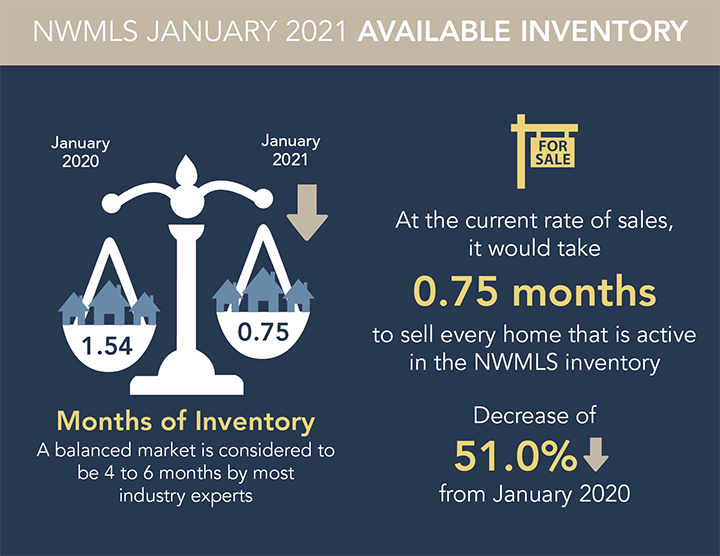

The number of for sale listings was down 49.6% from one year earlier and down 5.7% from the previous month. The number of sold listings increased 8.1% year over year and decreased 38.8% month over month. The number of under contract listings was up 16.8% compared to previousmonth and up 14.9% compared to previous year. The Months of Inventory based on Closed Sales is 0.7, down 51.9% from the previous year.

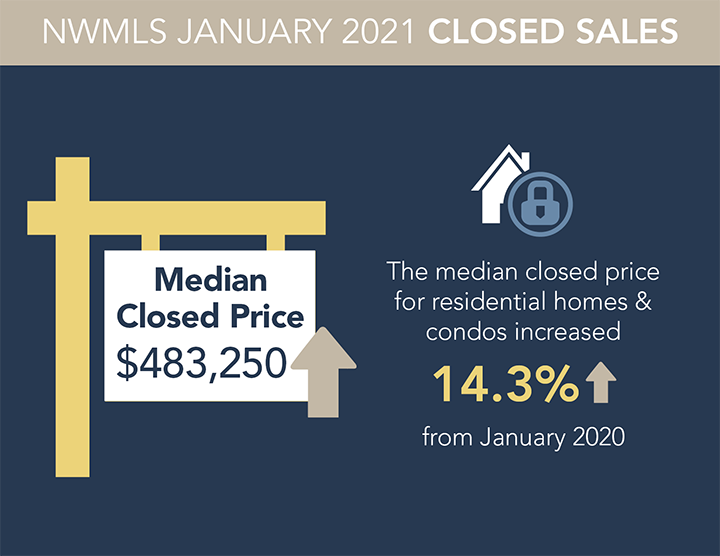

The Average Sold Price per Square Footage was up 0.3% compared to previous month and up 20.6% compared to last year. The Median Sold Price increased by2% from last month. The Average Sold Price also decreased by 0.8% from last month. Based on the 6 month trend, the Average Sold Price trend is "Depreciating"and the Median Sold Price trend is "Neutral".

The Average Days on Market showed a neutral trend, a decrease of 40.8% compared to previous year. The ratio of Sold Price vs. Original List Price is 100%, anincrease of 3.1% compared to previous year.

Property Sales (Sold)

January property sales were 4919, up 8.1% from 4549 in January of 2020 and38.8% lower than the 8035 sales last month.

Current Inventory (For Sale)

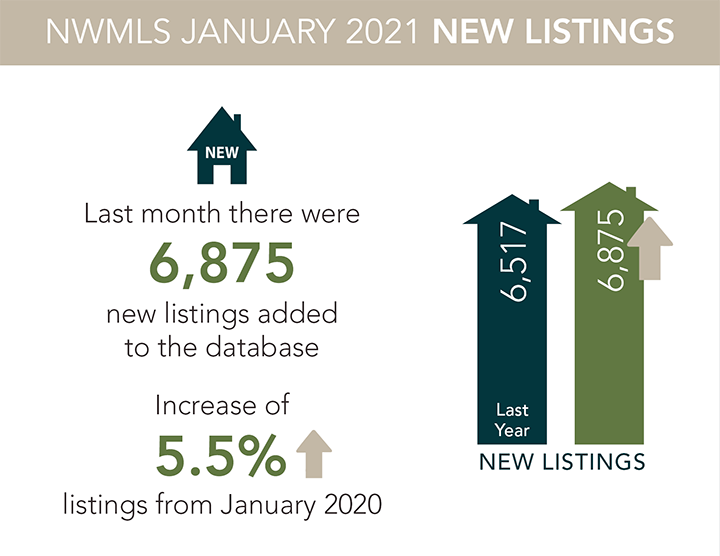

Versus last year, the total number of properties available this month is lower by3482 units of 49.6%. This year's smaller inventory means that buyers who waitedto buy may have smaller selection to choose from. The number of currentinventory is down 5.7% compared to the previous month.

Property Under Contract (Pended)

There was an increase of 16.8% in the pended properties in January, with 5993properties versus 5132 last month. This month's

With the trend toward telecommuting and moving to outlying suburban areas, the Seattle/King County condominium market presents a new option the county’s bigger supply of condos – 1.67 months of inventory versus 0.69 months for single family homes – and a slight break from double-digit appreciation, buyers may want to take a closer look at this “window of opportunity.” Condos can be a one bright spot for buyers. They are more reasonably priced and there are more months of inventory than with single family homes. With interest rates so low buyers should consider condos as an ownership opportunity and a way to build equity – especially if they’re currently renting. Of 4,432 active listings in the MLS system at the end of January, about one of every four offerings (1,051 units, or around 23.7%) was a condo, with the remaining 76% (3,381 listings) being a single family home. King County condo prices “entered negative territory in January,” down about one-half percentage point compared with the same month a year ago. Increased inventory as “likely due to COVID-19, possibly pointing to a growing number of homeowners who are choosing to move further away from core urban areas in favor of more space. It’s something to keep an eye on.

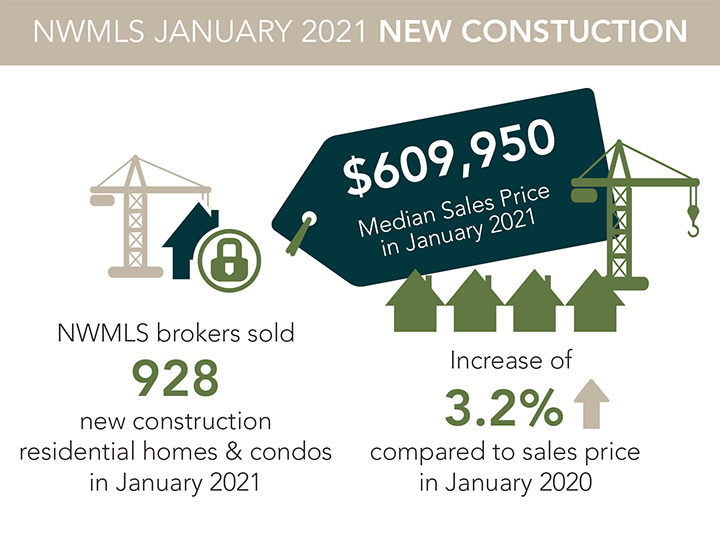

The market ignored the traditional winter slowdown and kept its foot firmly on the accelerator in January. While inventory levels were generally down in December, there was actually an uptick in new listings in King, Pierce, and Snohomish counties last month. Most of those homes sold so quickly they aren’t reflected in the overall total active inventory numbers. Clearly, demand is still very strong which is further confirmed by the fact that year-over-year (YOY) price growth remains well above long-term averages.

The economics of scarcity are driving prices up at an unsustainable pace. What will happen this spring and summer will likely be more of the same. The real estate vortex we’re in of depleted inventory and high prices is real and unrelenting. If interest rates weren’t historically low, buyers would be unable to afford the escalating cost of housing. Sellers are almost as rare as the dodo bird. Although the number of new listings coming onto the market has kept pace or even exceeded last year’s totals in some areas, new listings are immediately devoured by a plethora of waiting buyers. The situation has buyers asking, “Am I paying too much?” and sellers asking, “Can we ask more?” That answer for both is “Yes,”

The current market is described as “incredibly hot, even all the way up to some luxury price ranges.” Historically low interest rates remain a strong motivator for buyers.

The ongoing combination of very low mortgage rates and escalating prices has both buyers and sellers taking advantage of the market. Buyers are finding well-priced homes in good condition, and sellers are seeing many multiple offer situations.

This year’s “extraordinarily low inventory” (down 43% overall) suggests continued price growth into the spring as demand remains high and interest rates remain low. It is somewhat of a ‘prisoner’s dilemma’ for the housing market in Western Washington. Those who own do not want to sell because there is little inventory to buy. They will stay put. Those who want to buy (and get on the housing ladder) cannot get into the market because there is little available for sale.

Kitsap County, where inventory is down 42% from a year ago, is experiencing pent-up demand from buyers that want to move there or convert from being a renter. As a result, prices continue to creep up, rising more than 10% from a year ago. While this is great for sellers, it really hurts housing affordability.

Interview with Dan Golden of Cornerstone Home Lending by George Moorhead of Bentley Properties

George Moorhead of Bentley Properties Interviews Dan Golden of Cornerstone Home Lending To Give You A Deeper Insight About What You Need To Know in Today's Real Estate Market

For more Real Estate News and Advice, please tune in to our Facebook live every Saturday at 10AM

Follow us on Facebook: George Moorhead Bentley Properties

If you have any questions or comments you would like answered in next month's newsletter, email me at [email protected] and they will be included in the market update. OR if you would like more information on our unique systems and programs, call us at 425-236-6777 Or visit our website www.GeorgeMoorhead.com

GEORGE MOORHEAD - Bentley Properties

[email protected]

Direct: 425-236-6777

14205 SE 36th St., Suite 100, Bellevue WA 98006

www.GeorgeMoorhead.com